Tax calculation formula

On 3000 capital gain at 15. See your tax refund estimate.

Tax Calculation Spreadsheet Worksheet Template How To Memorize Things Printable Worksheets

On taxable income of 142600 145600 less capital gain of 3000 at joint-return rates.

. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Your household income location filing status and number of personal.

Income tax expense. Quickly Prepare and File Your 2021 Tax Return. Least of the above amounts.

Usually the vendor collects the sales tax from the consumer as the consumer makes. Income tax expense can be calculated as Earnings before taxes times an effective tax rate. We have created a formula to calculate the income tax using the IF function.

Ad E-file your taxes directly to the IRS. The tax calculation formula works for the amount of sales tax a person will have to pay on a transaction. Total Estimated Tax Burden.

Well calculate the difference on what you owe and what youve paid. To calculate the sales tax that is included in a companys receipts divide the total amount received for the items that are subject to sales tax by 1 the sales tax rate. Actual rent payment 10 of salary.

For consumers its good to know how the sales tax formula works so that you can properly budget for your purchases. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. If taxable income is under 22000.

The tax rate schedules for 2023 will be as follows. 50 of Basic salary metropolitan city 50 50000 25000. Since the taxable value is between 35 lakh to 50 lakh we will calculate tax until the 5th slab.

Calculate your gross income. This time different tax slabs will be used for calculating the tax. 15000 10 50000 10000.

Learn About Being a Cashier. Calculate the income tax expense and the businesss net income earnings. Fuel Tax.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. Note that irrespective of the chosen regime the basic income tax calculation formula remains the same. Percent of income to taxes.

Total tax before credits. Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports. Add up all your stipends and allowances this includes your basic salary TA DA HRA DA on TA reimbursements that is listed in your payslip and the Form 16 Part B.

Once this is done add. This will include all the components of your. First write down your annual gross salary you get.

Easily Approve Automated Matching Suggestions or Make Changes and Additions. By calculating the sum of all four sources of income we arrive at a gross income of 214000 for the individual in 2021. Gross Income 200000 10000 2000 2000 214000.

Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. From Simple to Advanced Income Taxes. The tax is 10 of.

Here is the formula used by an online income tax calculator - Total income tax Total. To add TDS tax codes. For married individuals filing joint returns and surviving spouses.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Our income tax calculator calculates your federal state and. Although it is lengthy but you can use the same data for all data given in this worksheet but by making a.

If youve already paid more than what you will owe in taxes youll likely receive a refund. In the case of a transaction the tax rate is determined from the charge. To define the calculation expression for the TDS tax code in the Calculation expression field add TDS tax codes that are available on the Taxes tab.

How to use the. 54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

How to Calculate Income Tax on Your Salary in 5 steps.

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Excel Learning Centers Tax Deductions

Excel Formula To Calculate Hours Worked And Overtime With Template Excel Formula Excel Life Skills

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

Investment Property Excel Spreadsheet Rental Property Rental Property Investment Investment Property

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

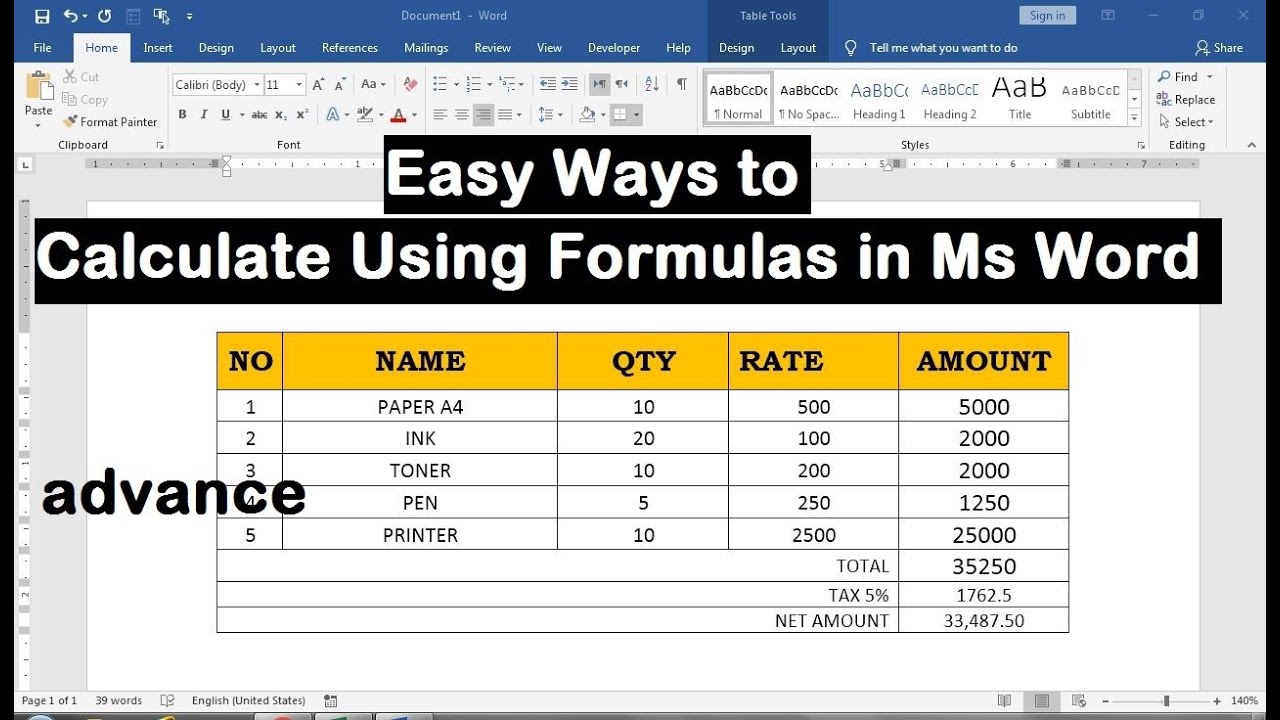

How To Calculate Formula In Ms Word Ms Word Words Formula

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Wacc Formula Calculator Example With Excel Template Excel Templates Formula Excel

End Of Year Inventory Template Calculate Beginning And Ending Inventory Excel Worksheet Excel Spreadsheets Templates Pricing Templates Types Of Taxes

Weighted Average Cost Of Capital Wacc Excel Formula Cost Of Capital Excel Formula Stock Analysis

Formula For Calculating Net Present Value Npv In Excel Formula Excel Economics A Level

How To Calculate Value At Risk Var In Excel Investing Standard Deviation Understanding

How To Calculate Freight Cost Per Unit In Excel Excel The Unit Calculator

Income Tax Calculator Python Income Tax Income Tax

Tax Calculation Spreadsheet In 2022 Spreadsheet Template Spreadsheet Excel Formula